This post is a collection of my class notes taken in the lectures by Dr. Jan Brinkmann from my classes at ESADE Business School, Spain. He is a professor, researcher, advisor, business angle with a passion of empowering entrepreneurs. He specializes in Validation, Fast-Growth, Performance-Marketing, Sales, B2B SaaS and Financing. The following notes are of his classes on Creating High-Growth Businesses.

- Restaurant Business model needs –

- Great exciting locations

- Reducing the human dependencies (chef)

- Serve Instagrammable food

- Target/invite more female customers (for viral growth)

- Ecommerce business needs – Repeat Business from existing customers

- Always focus on sales channels and reducing costs over time. Always check that you don’t depend entirely on a sales channel (eg: dependency on Google ad network)

- Unprofitable Startups types–

- Managed Unprofitable – Good to invest

They are the ones which show signs of stable future revenue after the initial cash burn or no-profit timeframe. - Inherently Unprofitable – Not Good to invest

They are the ones which are inherently never going to be profitable because of some reason like market dynamics, government policies etc.

- Managed Unprofitable – Good to invest

- Evaluating Growth Businesses

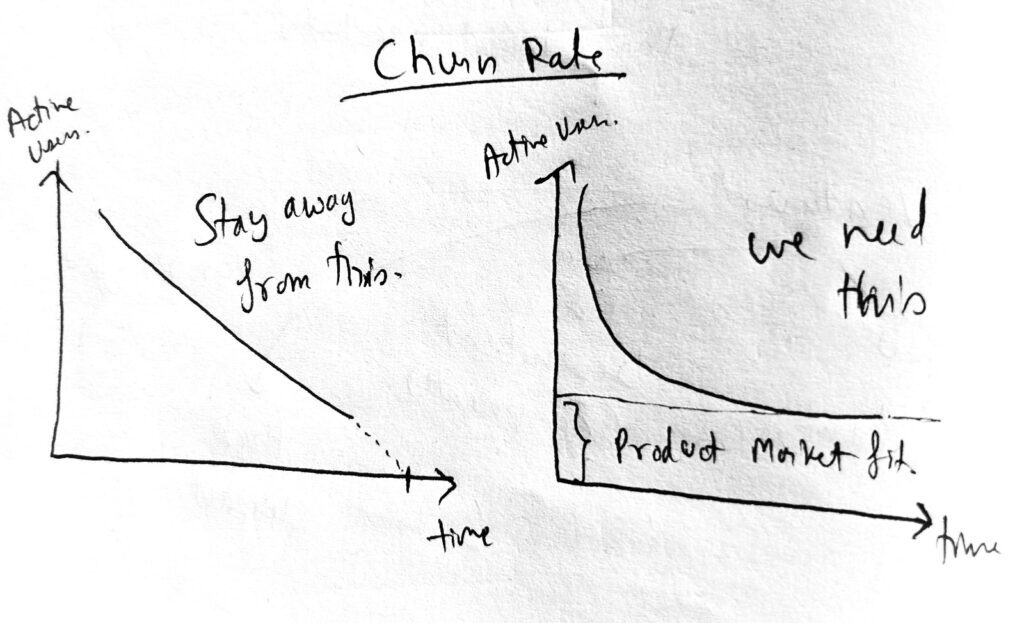

- Focus on numbers – Customer Retention (Churn rate) and Engagement Rates

- Reid Hoffman – Man behind Linkedin’s growth strategies

- Why Facebook succeeded ?

- Team was powerful

- Connections to financing was strong

- Idea may not be unique, but the execution was better than the competition

- Valuations

- Valuations = (Annual Revenue Potential) x (Market Multiplier Factor for valuations)

- Market multiplier for valuations is a dynamic multiplier factor that is decided by the market and is volatile. This basically determines what type of businesses are valued more in the market.

- Profitability

- We can’t see the true profitability of a company in its P&L statement, that’s just accounting. Profitability can be truly judged by the ratio of Customer acquisition costs to Customer Lifetime Value.

- CAC can be derived from SG&A

- CLV – Profits (not revenue)

- To conduct true profit analysis of a company, start with unit economics of the business (not often disclosed by the companies, but can be derived through social engineering)

- We can’t see the true profitability of a company in its P&L statement, that’s just accounting. Profitability can be truly judged by the ratio of Customer acquisition costs to Customer Lifetime Value.

- Building a Powerful Team for Growth Businesses (Must have qualities)

- CEO

- Vision, Strategy, Roadmap

- Manages Investors and Shareholders

- Handles HR functions – Team building and selections

- Sales

- CTO

- Building amazing products

- Be open and meet customers

- Hands on developer

- Team leader

- Product design

- CSO

- Selling amazing products in amazing ways

- Understands customer insights

- Handles great communication between customer and brand

- CPO (if product design and usage is critical to the business)

- Intuitive and easy to use Design of the product

- UI/UX knowledge for designing better product experience

- COO (if there are logistics in the business)

- Understanding of logistics and supply chain

- Relationship building

- Stakeholder management

- Sales team

- Good listeners (understands consumers pain points, aspirations and needs)

- Ask questions (that bring out consumer insights and deeper motivations of customers)

- Urgency to Act on consumer’s side (Determination)

- CEO

- Equity Division

- Beginning equity structure – 90% of the equity should be with the founders in a balanced manner and the rest 10% to the investors

- Founders need to be only full-time people, once the customers start to come in the business

- Don’t have more than 3 founders

- Shares to be given only to the core employees who stick for longer terms in the organization.

- Apart from the founders, everybody else earns equity.

- Final equity structure – 10% in IPO, 90% for Merger & Acquisitions (probably in the US or developed markets)

- Core Mechanics of Investing in a Startup

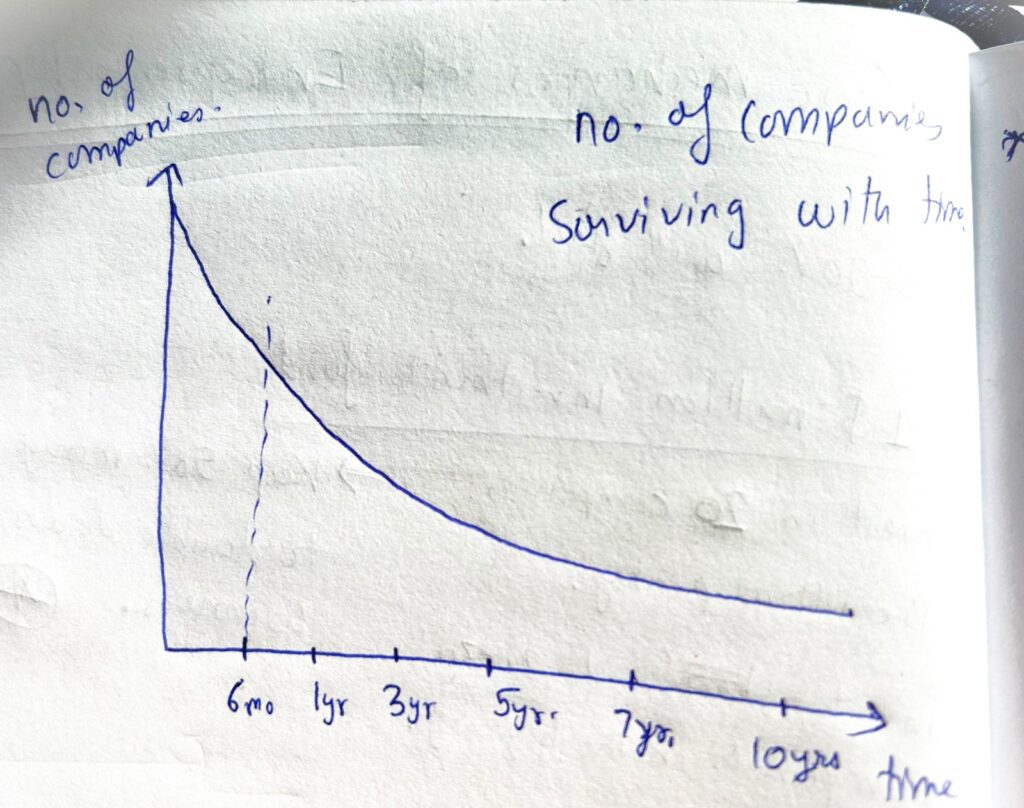

- 90% of the startups will fail

- Keep 50% of the investment fund safe for doubling down money on the winners later. Do not put all your money at risk by investing it on startups, keep some money to support winners later.

- Investment portfolio must have 20-30 companies in the portfolio.

- Focus on winners, write-off losers.

- We need atleast 15x returns from our investments to consider them as winners.

- Benchmark timeline is generally 10 years

- 50-60% VCs fail in their portfolios, thus, it’s okay to be ultra picky while choosing investment opportunities before investing.

- No investor invests in the first 6 months of a business – High Risk of failure

- FFF invest in the first 6 months – Friends, Family and Fools (all are fools)

- Good VCs generally earn an YoY return of 22.4% on an average on their investments. That means, they need atleast 5/10 winners in investment portfolio with a return of 7.5x in 10 years.

- Risk Reduction for high growth businesses

- Conduct Root Cause Analysis of all problems around the business

- Solve then one-by-one and get risks under control.

- RCA of Why most businesses fail?

- Issue with the team

- Issue with Business Model (CAC, CLV, Churn rate, network effect )

- Market

- Type- Fragmented market v/s Winner Takes All

- Competition is necessary (it validates the market)

- Market size (Always start with a niche and be the #1 in that niche)

- Market Growth (high the better)

- Product Market Fit (if we have all 3, we have customer retention)

- Target Customers

- Value Proposition

- Product

- Sales Channel

- Logistics

- Some examples of Ultra Competitive Businesses – Where we should NOT invest!

- Restaurants Businesses

- Delivery Businesses

- Style Consulting

- One stop shop for XXX

- Blockchain for XXX

- Drone Inspection

- Mental Health Platforms

- Local Chef

- AirBnb for XXX